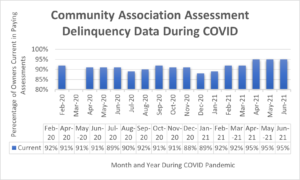

The COVID-19 pandemic has had staggering impacts on the U.S. economy as many businesses shuttered and many Americans were laid off, had reduced hours at work, or experienced other financial hardship during the global crisis. CAI began surveying members in April 2020 about the status of community association assessment payments as one component to help monitor and quantify the financial impact of COVID-19.

Thousands of CAI members have responded to these surveys, including board members, community managers, and management company executives. Nearly half (49%) of respondents represent homeowners associations, followed by condominium communities (41%), housing cooperatives (1%), townhome communities (2%), and associations with a mix of housing (7%).

Data collection benchmarks against statistics from February 2020, just prior to COVID-19 being declared a pandemic. Here are the results as of June 2021:

A federal moratorium on mortgage foreclosures was implemented in March 2020 and extended multiple times throughout the pandemic before expiring this past July. CAI’s recommendation for a voluntary moratorium on foreclosure actions also ended when the federal mortgage foreclosure moratorium expired.

ATTOM, licensor of the nation’s most comprehensive foreclosure data, shows in its August U.S. Foreclosure Market Report that there were a total of 15,838 properties with foreclosure filings such as default notices, scheduled auctions, or bank repossessions, up 27% from a month ago when the foreclosure moratorium expired and up 60% from a year ago. The number is relatively low because mortgage providers are still required to offer forbearance and other relief options to homeowners facing financial impacts related to COVID-19.

According to ATTOM’s report, states with the greatest number of foreclosure starts in August were California (1,240), Texas (1,060), Florida (643), Illinois (506), and New York (479). Major metropolitan areas (those with a population greater than 1 million) with the highest number of foreclosure starts included New York City (486), Chicago (439), Los Angeles (401), Houston (322), and Dallas-Fort Worth (248). In addition, the major metropolitan areas with the worst foreclosure rates were Cleveland, Las Vegas, Chicago (1 in 3,754 housing units), Riverside, Calif. (1 in 4,098 housing units), and Birmingham, Ala. (1 in 4,649 housing units).

While these foreclosures procedures are starting, President Joe Biden’s administration has established new loan modification and payment reduction options. Mortgage servicers are encouraged to proactively work with eligible borrowers and provide these options.

Federal Housing Administration loans: The new guidelines from the Department of Housing and Urban Development, which apply to all homeowners with loans from FHA, require borrowers impacted by COVID-19 to be offered a no-cost option for resuming mortgage payments. FHA borrowers who cannot resume their monthly payments may be eligible for a 25% reduction to their principal and interest payment as part of a loan modification. This relief will be offered through two programs: COVID-19 Recovery Modification and COVID-19 Recovery Standalone Partial Claim.

Department of Agriculture COVID-19 Special Relief Measure: Eligible USDA loan borrowers can access a combination of reductions, extensions, and other relief options.

Veterans Affairs COVID-19 Refund Modification: Assists eligible VA Loan borrows to access a 20% or more reduction in monthly principal and interest payments.

Federal Housing Finance Agency (FHFA): Fannie Mae and Freddie Mac loans have a forbearance enrollment extension through Sept. 30, and there are additional COVID-19 loss mitigation options from the Federal Housing Finance Agency.

Homeowner Assistance Fund: President Biden’s American Rescue Plan provides $9.961 billion toward homeowners whose finances were negatively impacted by COVID-19. These funds will be integrated into payment reduction options and can be used to assist with mortgage payments, homeowner’s insurance, or utility payments. These funds are available through state housing finance agencies.

At this time, most states are still in the process of developing their plans and awaiting approval from the federal government for release of funds. However, CAI expects these funds will be available in the next few months. For information about your state, visit www.caionline.org/HAF.aspx.

Community Association owners have these mortgage and rental options. I have never seen assessments included in eviction proceedings. Can CAI introduce educational opportunities to our governing officials regarding the definition of assessments: landscaping/snow removal/plumbing issues impacting others, etc. Evictions are necessary as non-payment of assessments impacts so many.