Governments regulate business. But, why? Most often commerce is regulated for consumer protection, employee protection, and environment protection. Real estate agent/broker lobbies have been introducing legislation throughout the country under the guise of consumer protection. The legislation proposed by the real estate lobby arbitrarily and capriciously invokes a cap on fees a community association or their managing agent may charge for important documentation provided to purchasers during a sale of a home in a community association. The real estate lobby accuses community associations and their managing agents of charging “exorbitant” fees for these important documents.

First, I will talk about the important consumer protection information is provided in these important documents. Then, I will talk about exorbitant fees charges at the closing of a sale of a home.

In 2018, the real estate lobby is claiming, throughout the country, community associations are charging “exorbitant fees” for information provided for real estate closings in community associations. These claims resulted in legislation in Georgia, Idaho, Rhode Island, and Wisconsin. The important consumer protection information provided to purchasers includes a host of information. In many cases, it includes information that may require the engagement of the association’s attorney to check for lawsuits, the managing agent to verify the status of assessments, pending special assessments, and outstanding violations and the association’s insurance professional.

The real estate lobby claims, the association “just has to press a button to print these documents” for the purchasers. That’s simply untrue. The information provided for closing is different for every single home/unit in the association, so the information is custom. Every time.

The association or its managing agent incurs fees related to preparing and delivering accurate information as required by law and to protect purchase by providing them clear information about their financial obligations.

The information provided by a community association to a purchaser is very important information about community association financial obligations, insurance coverage, covenants and resections, financial stability, insurance coverage, and more. It is critical this information is current and accurate. These are consumer protection documents that help consumers gain invaluable information about the community in which they are purchasing their home.

Let’s talk about exorbitant fees; the Economist published an article entitled “The Great Realtor Rip-off” where they quoted a University of Chicago Paper entitled “Can Free Entry Be Inefficient? Fixed Commission and Social Waste in the Real Estate Industry.” The University of Chicago Paper finds that American real estate brokers cause “social waste” of $8 billion a year via overcharging and inefficiency.

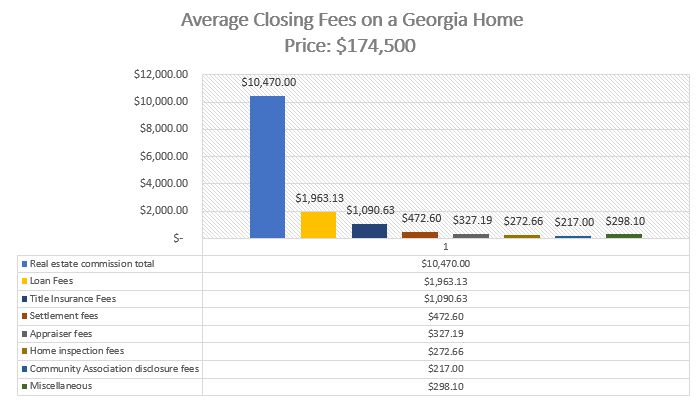

Below is a chart created by Homewise that illustrates the closing fees for an example in Georgia:

In looking at the fees above, only one looks to quality as exorbitant.

Community associations make up nearly ¼ of the housing stock in the U.S. the community association housing model, as we know, is unique. The model relies upon co-ownership of common elements; some of which are municipal-like in nature and others are luxurious amenities. The financial model of the community association is that of a non-profit shareholder group whereby each owner contributes via monthly assessments to insure, maintain, and protect their common property. Nobody in the community association is getting a windfall from the consumer protection information provided to purchasers at closing.

CAI is advocating on your behalf to protect community associations from this type of terrible public policy. For information about legislation in which CAI is tracking and advocating in your state, visit here.