The Paycheck Protection Program (PPP) is a $349 billion federal government loan and grant program to help small businesses remain solvent and retain employees during the COVID-19 pandemic.

- The PPP is administered through the Small Business Administration 7(a) loan program. Applicants must work with an approved SBA lender (bank, credit union, or other approved lender) to apply for PPP loans.

- Small businesses and sole proprietorships may apply for PPP loans beginning April 3, 2020. Independent contractors and self-employed individuals may apply for PPP loans beginning April 10, 2020.

- Under current law, the PPP program will cease accepting applications on June 30, 2020, or when the program’s lending authority cap is reached, whichever is sooner.

How to Apply

- Working with your SBA-approved lender, complete the PPP Loan Application, available at https://home.treasury.gov/system/files/136/Paycheck-Protection-Program-Application-3-30-2020-v3.pdf

- For a list of SBA-approved lenders, visit https://www.sba.gov/paycheckprotection/find

Who can apply for a PPP Loan?

Businesses with fewer than 500 employees are eligible to apply for PPP loans. Types of businesses include sole proprietors, independent contractors, self-employed individuals, 501(c)(3) charities, veterans’ service organizations, and certain Tribal businesses. All applicants must provide documentation proving the applicant was operational prior to February 15, 2020.

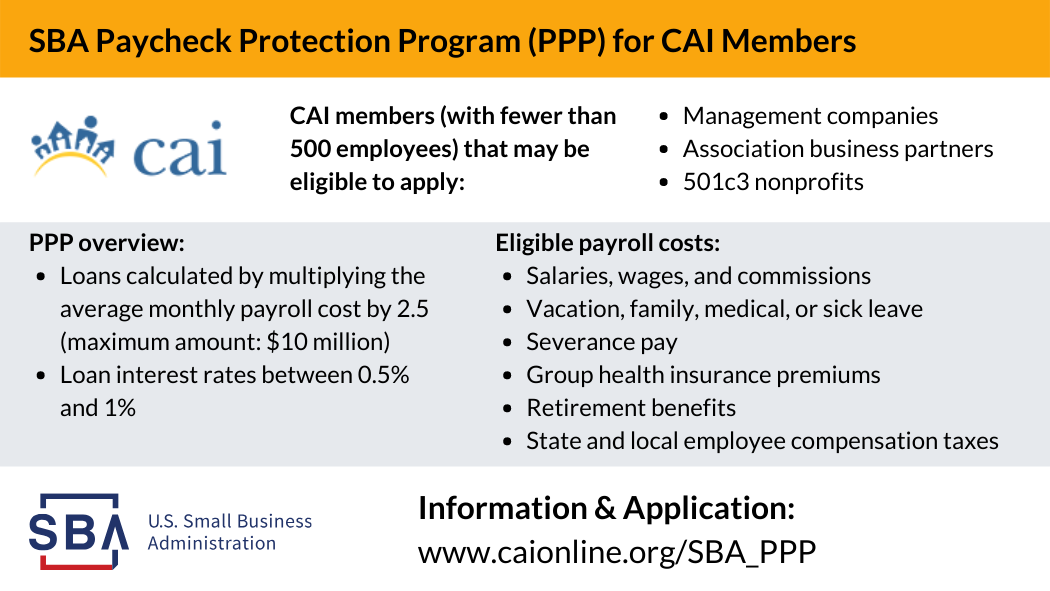

Eligible entities include 501C3 and veteran-related non-profits and small businesses (under 500 employees). Please check with your bank and other professionals for information regarding eligibility. Specifically, the following CAI members may be eligible.

- Management companies

- Association business partners

How much can be borrowed?

The maximum PPP loan amount per borrower is the lesser of a formula-based payroll calculation or $10 million.

Maximum loan amounts are the product of multiplying the average monthly payroll costs of the one-year period before loan application by 2.5. For example, ($25,000 average monthly payroll costs April 1, 2019, to March 31, 2020) X (2.5) = $62,500 maximum loan amount).

Applicants operational prior to February 15, 2020, but not operational for a year will use average payroll costs for January 2020 and February 2020 as the payroll variable in the maximum loan amount formula.

What are the eligible uses of PPP loan proceeds?

Borrowers may use loan proceeds to meet eligible payroll costs (see restrictions below), mortgage interest payments, rent, utilities, and interest on other debt incurred before February 15, 2020.

Eligible Payroll Costs

|

Ineligible Payroll Costs

|

Loan Forgiveness

Loan disbursements used during the eight weeks immediately following loan origination to fulfill payroll, rent, utilities, and mortgage interest obligations are eligible to be forgiven.

Loan Terms for Non-Forgivable Balance

Non-forgivable loan balances are payable over a two-year term with an interest rate of 1%. There are no prepayment fees.

Applicant Certification and Documentation Requirements

Applicants must certify (1) current economic circumstances make a PPP loan necessary to support ongoing operations (2) PPP loan proceeds will be used to retain workers and maintain payroll, or make eligible mortgage, lease, and utility payments, and (3) the applicant has not been approved for another PPP loan.

Applicants must document the number of full-time equivalent employees, payroll costs, and dollar amounts of eligible mortgage, lease, and utility payments. Loan forgiveness will only be considered for eligible costs that are verified and documented.

Collateral is not required for Paycheck Protection Program loans nor are applicants required to personally guarantee PPP loans.

How to Apply

Working with your SBA-approved lender, complete the Paycheck Protection Program Loan Application, available at https://home.treasury.gov/system/files/136/Paycheck-Protection-Program-Application-3-30-2020-v3.pdf

For a list of SBA-approved lenders, visit https://www.sba.gov/paycheckprotection/find

Click here for information regarding FEDERAL GOVERNMENT ACTIONS during the COVID-19 pandemic, and CAI’s analysis on how these federal laws impact community associations.

Click here to download CAI’s Guide to SBA Payment Protection Program (PPP).