For guidance on post-Hurricane Ian debris removal, visit: https://www.caionline.org/Advocacy/LAC/FL/Documents/Hurricane%20Ian%20Community%20Association%20Debris%20Cleanup.pdf

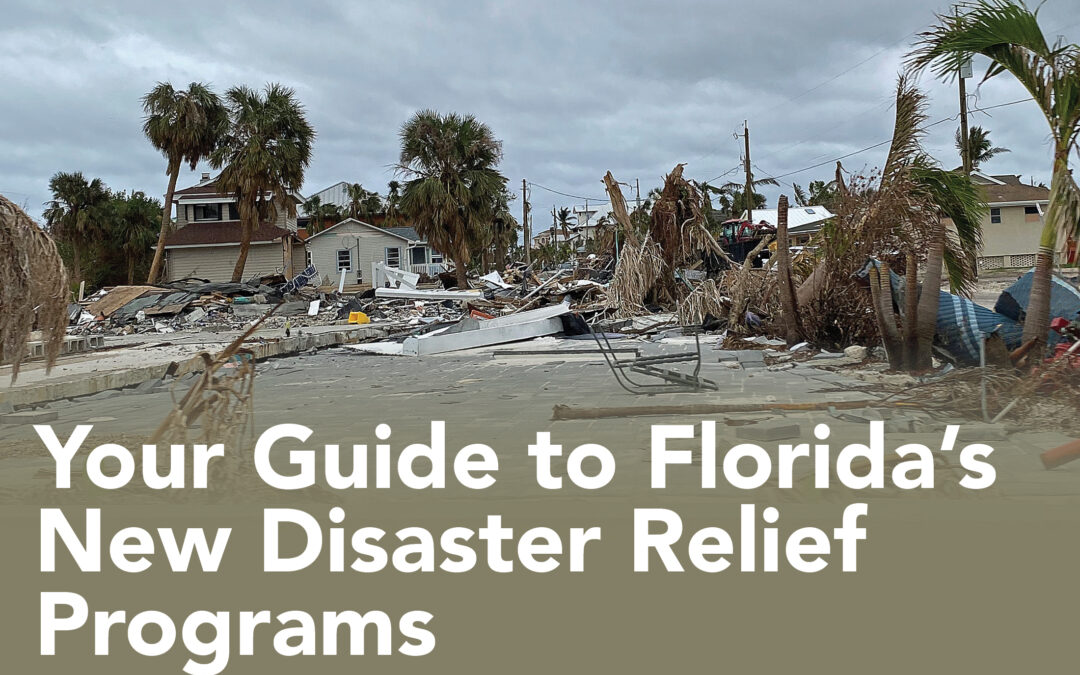

As homeowners across the Sunshine State recover from hurricanes Ian and Nicole, CAI is committed to providing members with accurate, up-to-date information on new programs designed to help homeowners. At the end of 2022, the Florida State Legislature called a Special Legislative Session specifically to address the financial struggles being faced by homeowners in the wake of the storms as well as the ongoing volatility of the insurance market. Two major pieces of legislation were passed, each with dedicated funds to assist Floridians: SB 4A, Disaster Relief, and SB 2A, Property Insurance.

SB 4A, Disaster Relief

This bill creates a variety of disaster relief programs specifically for residents of Brevard, Broward, Charlotte, Collier, Duval, Flagler, Indian River, Lee, Manatee, Martin, Nassau, Palm Beach, Saint Johns, Saint Lucie, Sarasota, and Volusia counties. The $750.5 million appropriation contains:

Tax refunds for residential improvements rendered uninhabitable:

- Excluded from eligibility: a structure that is not essential to the use and occupancy of the residential dwelling or house, including, but not limited to, a detached utility building, detached carport, detached garage, bulkhead, fence, or swimming pool. Land is not included either.

- If the residential improvement is rendered uninhabitable for at least 30 days, then 2022 property taxes will be reimbursed to an amount equivalent to the amount of time the residential improvement was rendered uninhabitable, relative to the value, change in value, and post disaster value of the residential parcel. A property appraiser determines the amount to be reimbursed.

- Application requirements. The application for refund must identify the residential parcel and the number of days the residential improvement was uninhabitable during 2022. Documentation required includes utility bills, insurance information, contractors’ statements, building permit applications, or building inspection certificates of occupancy.

- Application deadline is April 1. Funds are available for disbursement until Jan. 1, 2024.

Hurricane restoration reimbursement grant program:

- Application period began Feb. 1 and expires July 1.

- Eligible properties include single-family homes, condominiums, and cooperatives, and the owner must have been granted a homestead exemption.

- Application requirements. The application must include, if pertinent, the permit issued, evidence that the project complies with all permitting requirements, as well as all invoices and payment receipts. If applicable, it also should include documentation that the eligible project was completed by a licensed professional or contractor.

- Grant funding may only be used to reimburse a property owner for construction costs:

- Related to sand placement and temporary or permanent coastal armoring construction projects to mitigate coastal beach erosion and may not be used for the repair of residential structures.

- Incurred because of preparation for or damage sustained from Hurricane Ian or Hurricane Nicole in 2022.

- Incurred after Sept. 23.

- Related to a project that has been permitted, is exempt from permitting requirements, or is otherwise authorized by law.

- Funding formula. $1 provided by the state for every $1 provided by the property owner, with a maximum of $150,000.

- Applicants who are low income or moderate income will be prioritized. Grants are awarded to property owners on a first-come, first-served basis.

Hurricane housing recovery program:

- The total for this program is $60 million with up to $25 million of funding available to assist homeowners in paying insurance deductibles. The rest goes to eligible counties and municipalities (based on FEMA data) to assist residents with repair/replacement of housing, acquisition of building materials for home repair, repair/replacement/relocation assistance for manufactured homes, and housing reentry assistance.

Additionally, the bill creates the Florida Emergency Management Assistance Foundation, a nonprofit entity that will provide funding and direct assistance to the Florida Division of Emergency Management, local governments, and individual residents impacted by future natural disasters.

SB 2A, Property Insurance

This $1.758 million appropriation creates the following new insurance programs, aimed at insurers and consumers:

Florida Optional Reinsurance Assistance Program (FORA):

- Provides optional coverage for insurers participating in the existing Florida Hurricane Catastrophe Fund. There are multiple layers of coverage offered to insurers, with limits depending on the formula adopted for each layer.

Additionally, insurers are, under this bill, subject to additional regulatory scrutiny by the state, with the goal of protecting consumers and ensuring that best practices are adhered to when claims are being processed.

- The Citizens Property Insurance Corporation is charged with creating the Citizens Account, which consolidates the existing coastal, personal lines, and commercial accounts.

- The Citizens Account can issue:

- Personal residential policies that provide comprehensive, multiperil coverage on risks that are not located in areas eligible for coverage by the Florida Windstorm Underwriting Association, and for policies that do not provide coverage for wind that are in these areas.

- Commercial residential and commercial nonresidential policies that provide coverage for basic property perils on risks that are not located in areas eligible for coverage by the Florida Windstorm Underwriting Association, and for policies that do not provide coverage for the peril of wind on risks that are in these areas.

- Personal residential policies and commercial residential and commercial nonresidential property policies that provide coverage for the peril of wind on risks that are in areas eligible for coverage by the Florida Windstorm Underwriting Association. New policies offered in these areas can only cover wind, however multiperil policies that have been in place since June 30, 2014, are able to continue as is. New policyholders in these areas may purchase additional multiperil coverage at no penalty from the Citizens Property Insurance Corporation.

- The areas eligible for coverage by the Florida Windstorm Underwriting Association are defined as being in Port Canaveral, is bordered on the south by the City of Cape Canaveral, bordered on the west by the Banana River, and bordered on the north by federal government property.

Please reach out to CAI at government@caionline.org with any questions. As these programs are implemented, this post may be updated to reflect current requirements.