More than 100 advocates met with 150 congressional offices and federal lawmakers to educate them about the community association housing model during CAI’s recent 2018 Advocacy Summit in Washington, D.C. Attendees specifically pushed for reform of the Federal Housing Administration (FHA) condominium program during their visits. A critical component of FHA’s mission is serving first-time homebuyers and minority borrowers. Currently, only six percent of U.S. condominium projects are approved by the FHA, and 93 percent of condominium homeowners have no access to FHA-insured mortgages.

Summit attendees’ efforts already are paying dividends by Senators initiating and support this important letter to HUD. Immediately following the event, Senators Tim Scott (R-SC) and Robert Menendez (D-NJ) asked CAI to recruit other senators to cosign a letter they drafted to Housing and Urban Development Secretary Ben Carson on the need to update FHA condominium rules. With your help, I believe CAI can persuade even more to sign the letter. Constituent contact is what opens doors for CAI’s lobbying team on your behalf. It truly is a team effort, and we can’t do it without you.

To date, 25 Senators (see below) have cosigned the Scott-Menendez condominium letter. The deadline to cosign is June 11.

Don’t see your senator(s) on the list? Contact her or him via CAI’s Advocacy Portal and ask your representatives to add their names to the Scott-Menendez FHA condominium letter.

| Sen. Tim Scott (SC) | Sen. Robert Menendez (NJ) | Sen. Marco Rubio (FL) |

| Sen. Johnny Isakson (GA) | Sen. Mazie Hirono (HI) | Sen. Joni Ernst (IA) |

| Sen. Tammie Duckworth (IL) | Sen. Todd Young (IN) | Sen. Elizabeth Warren (MA) Sen. Edward Markey (MA) |

| Sen. Amy Klobuchar (MN) Sen. Tina Smith (MN) |

Sen. Jon Tester (MT) Sen. Steve Daines (MT) |

Sen. Heidi Heitkamp (ND) |

| Sen. Jeanne Shaheen (NH) Sen. Maggie Hassan (NH) |

Sen. Catherine Cortez Masto (NV) Sen. Dean Heller (NV) |

Sen. Robert Portman (OH) |

| Sen. Robert Merkley (OR) | Sen. Mike Rounds (SD) | Sen. Tim Kaine (VA) |

| Sen. John Barrasso (WY) Sen. Mike Enzi (WY) |

Most condominium homeowners and homebuyers have only limited access to FHA-insured mortgages, which reduces lending competition and results in higher mortgage fees for condominium borrowers.

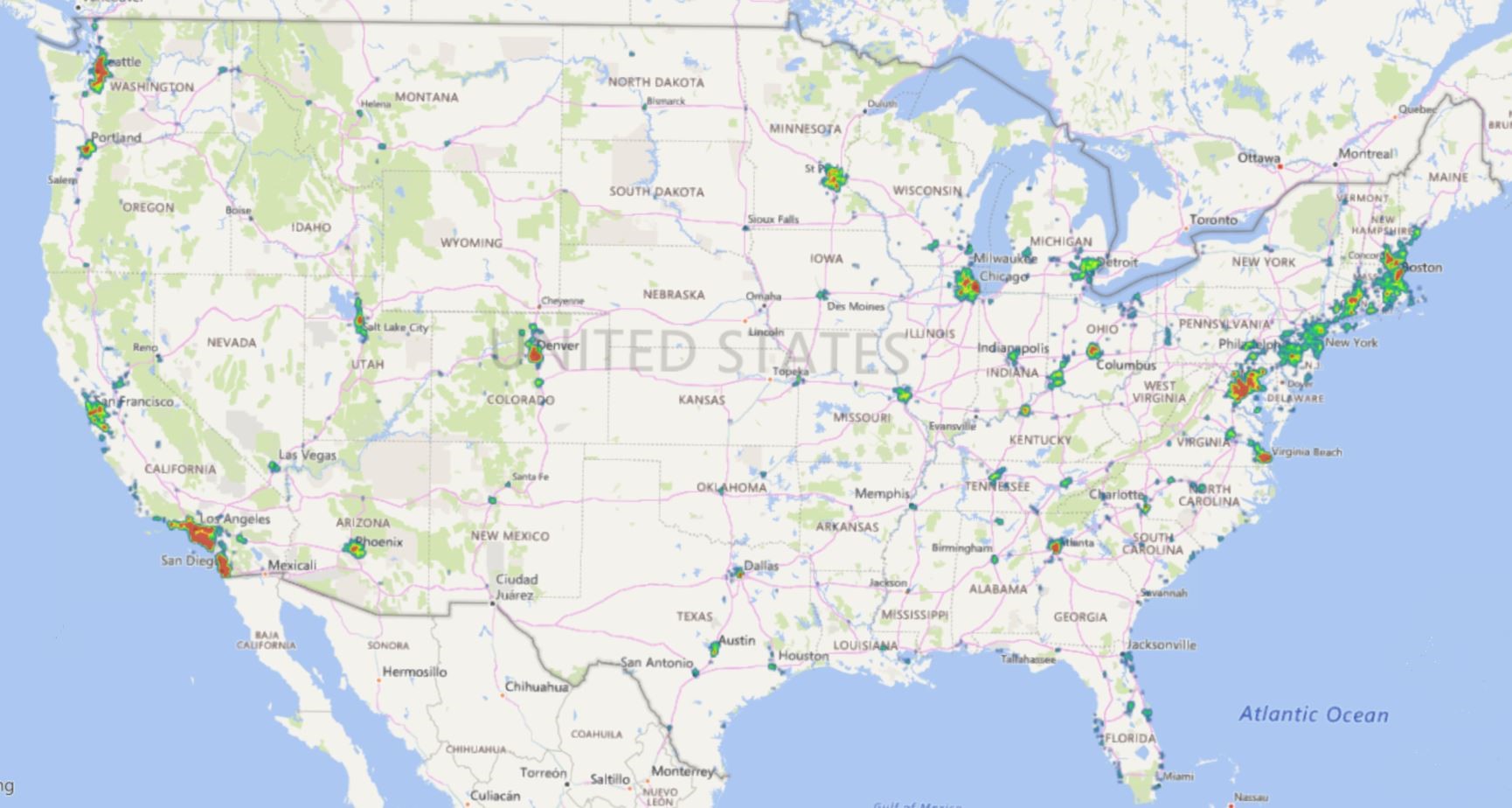

The map below shows the approximate location of each FHA-approved condominium in the lower 48 states as of March 2018. More than 50 percent of FHA-approved condominiums are concentrated in a handful of states.

Consider West Virginia. As of June 5, only two condominiums in the state are FHA approved, with 36 condominium units eligible for FHA-insured mortgages.

In Texas, 132 condominiums are FHA approved, which is almost equal to the number of FHA-approved condominiums in Washington, D.C.

The chart below illustrates the severity of the FHA’s burdensome condominium approval process, implemented in 2010, and the credit crunch it created. The data show FHA essentially vanished from the condominium market in 2011.